# Project Munnie

Project Munnie is a bookkeeping tool I created to get better understanding of my personal finances in an efficient manner.

Some basic understanding of how and what you are spending is important; especially if you want to improve your lifestyle. Not only you can improve it by earning more but also and even more importantly by lowering your costs. Freeing the money you have from the need to buy more and more stuff you don't need is thereby a powerful concept. By truly looking at your expenses you might be surprised by what your you are really spending!

Personally I like to simplify my life. Less stuff, less material, less weight. I have maybe a love and hate relationship with stuff. Since I am a product developer I love to create things but by times I can't wait to get rid off all the things I do not really need. On the other side I value my time. I value my time more than the things I have. So that is why I wanted to see what the minimum amount of time is I need to spend to get my life going. Even if you life on a "higher lever" it is important, because it is your base, and from there you can go into any direction you want.

Understanding your expenses by simply creating a list and counting things up is in my vision a bad habit. The best thing you can do is looking backwards to your real expenses and categorize each of them. Therefore I pay always by pin (Dutch bank card) since then all my transactions are recorded and I can just simply download them into a *.csv file. Previously I categorized all my bank transactions by hand in Excel. Project Munnie is a tool that automates this process somewhat and it adds charts and tables for financial insights with one click.

Go to Project Munnie HERE (opens new window).

# Disclaimer

Before you continue to read you have to know what Project munnie is not.

- It is not a professional tool in any sense. It is a hobby project build by someone who wanted to create something for himself out of interest.

- For now I am also not updating the tool. It works for me, sometimes I like to change things, but you have to use it on your own responsibility.

- It is build as a modern web-tool. Thus it works only in a modern web browser. By this I mean Google Chrome.

- Currently I've only tested it with my personal Dutch Bank: ING. It works but, I am sure that it wont work with all other banks. Maybe some Dutch banks. It depends on how the *.csv file, you need to download from your bank, is formatted.

- Some things are not always user friendly. It doesn't work with magical algoritms or machine learning. Project Munnie is more an example how a few 'simple' lines of Javascript can really be useful for daily life!

- It is designed for desktop usage.

- It is written in Dutch.

# Usage

The usage of Project Munnie consists of four steps:

- Download a *.csv file with a full year of bank transactions and import that file into Project Munnie.

- Create search terms.

- Check if Project Munnie categorised all the transactions into the categories.

- Analyse the rapports.

- Download a *.munnie file for storage.

# Download the raw data

To download a *.csv (comma seperated values) file go to mijn.ing.nl and find the downloads section. Make sure you select data from only one year, since Project Munnie currently does not discriminate between januari 2016 or januari 2015 for instance.

Make also sure the *.csv file consists of these collumn names:

- "Datum"

- "Naam / Omschrijving"

- "Rekening","Tegenrekening"

- "Code"

- "Af Bij"

- "Bedrag (EUR)"

- "MutatieSoort"

- "Mededelingen"

When you import the data for the first time select 'importeer transactie->overschrijven'. When you later add more transactions (of the same year), click 'importeer transactie->toevoegen'

TIP

Project Munnie doesn't store any of your data. When you refresh your browser all the imported data and changes will be lost. All the actions are done in memory. In my opinion this the safest way. If you want to save changes however simply click: 'PROJECT MUNNIE->Opslaan'. You will get a file that you can import for later usage.

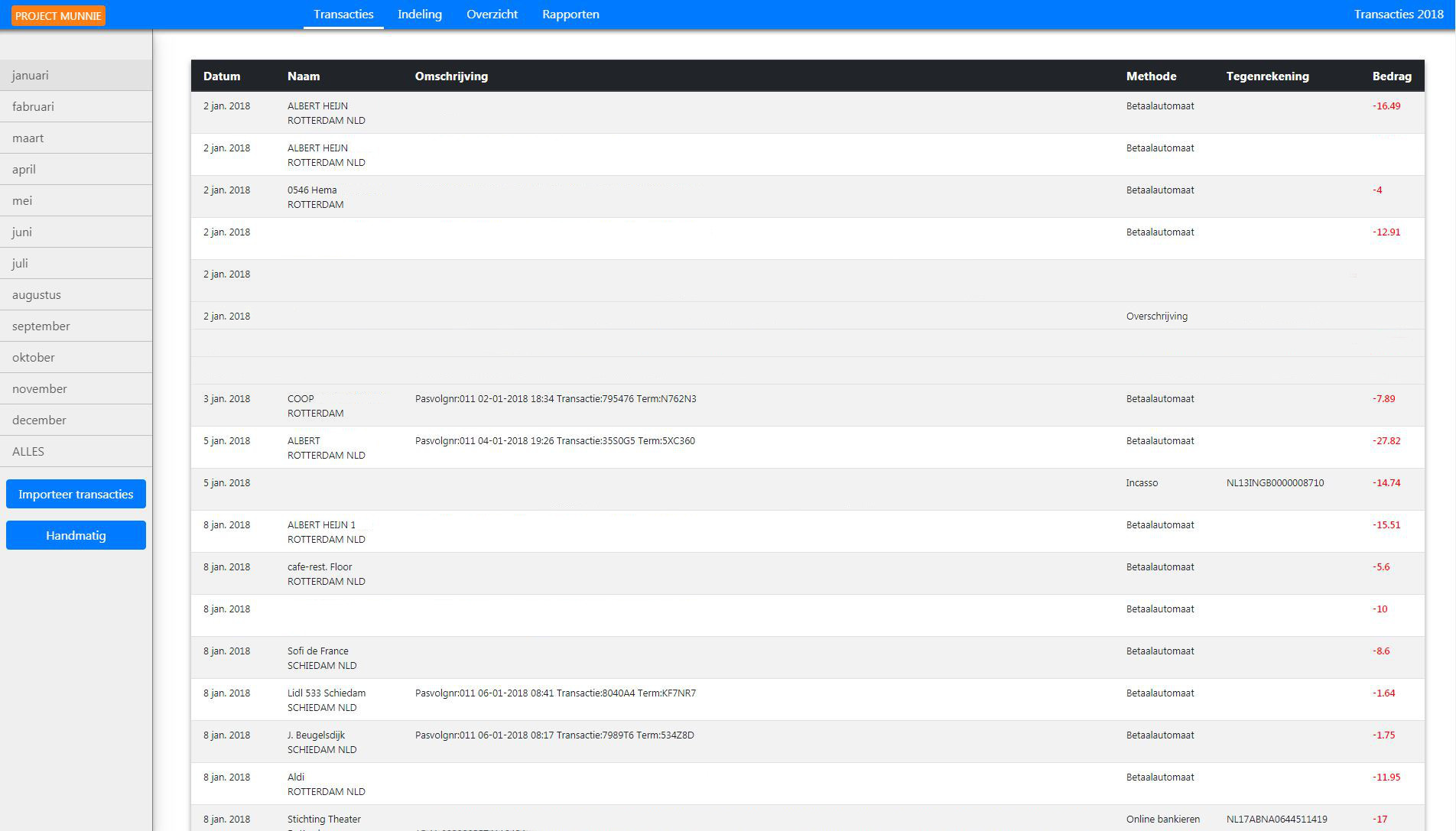

After importing the raw .csv you will see at the transactions page the raw data filtered by each month.

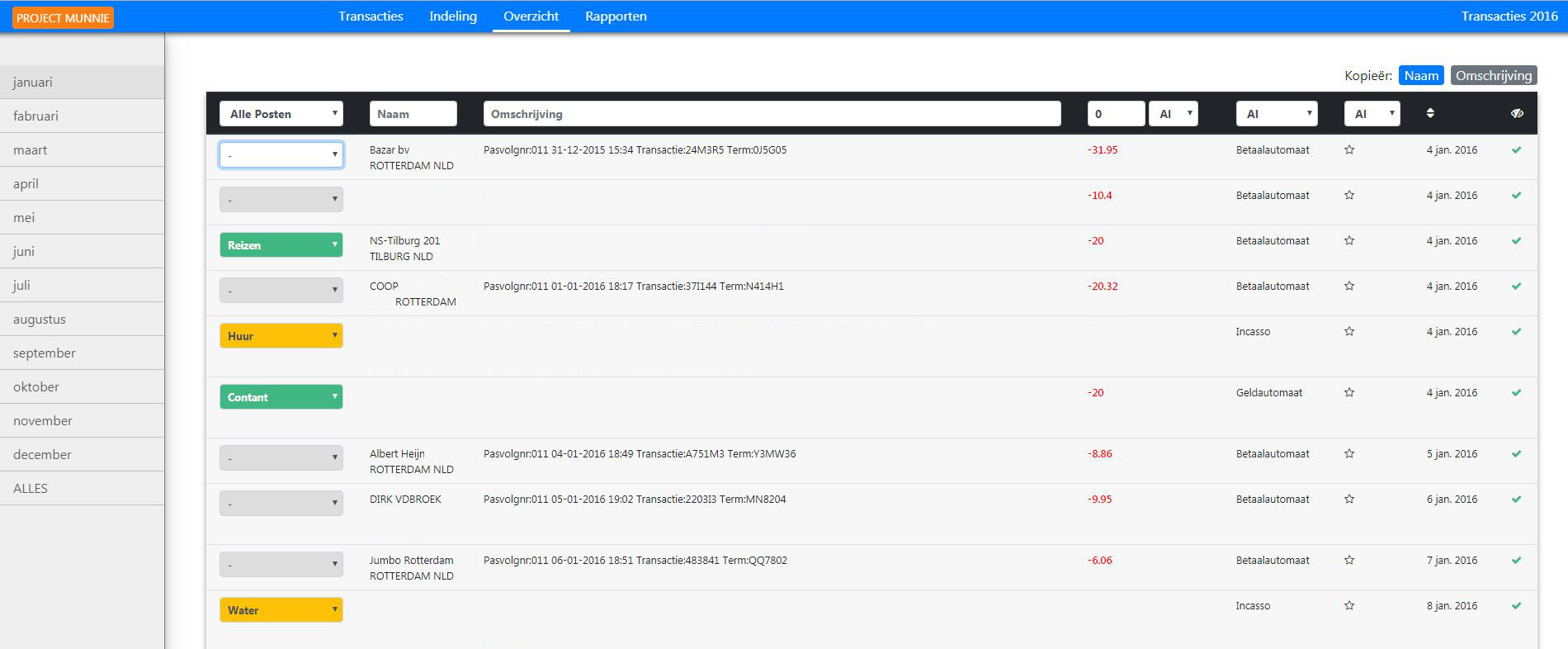

# Create search terms

For Project Munnie to be able to categorize each individual transaction it requires you to:

- First setup your main categories like: 'vaste uitgaven','vast inkomsten','variabele uitgaven', or ' fixed income','fixed expenses','variable expenses'. It is up to you but this is what I like. You can add and remove categories however you want.

- Secondly you need to add for each category a sub-category, like 'salary' under 'fixed income' and 'rental' under 'fixed expenses'.

- Thirdly you need to add search terms under each subcategory. Thus underneath 'food' I have added 'Albert Heijn' and 'jumbo' etc etc.

When Project Munnie loops through each transaction it adds a category to that transaction depending on the matched search term with the name or description of that transaction. Adding all the needed search terms will require a lot of manual labor! However when you have added 'Albert Heijn' under 'food' once it will categorize all future transactions matched with 'Albert Heijn' automatically to 'food'. Over time you will collect a personal library of search terms Project Munnie uses to automatically categorize transations. The more often you use Project Munnie the less time it will cost.

WARNING

- When you misspell a word like 'Albrt hyne' it simply wont recognize it as Albert Heijn.

- When you use 'Albert Heijn' as search term and a transaction is named 'Albert H' it doesn't work. It does work the other way around however. So the search term is 'Albert H' and the the the name is 'Albert Heijn'.

- When a search term is found in multiple categories errors can happen. If you use a search term like ING (Dutch bank) Project Munnie will think that a transaction named 'Booking' should to be categorise simular to 'ING', since 'ing' is within the word 'booking'. It is important to understand this.

- When a search term is used multiple times. Project Munnie gives a red number behind that search term as a warning. You have to fix this before reading the rapports.

- So yes it is a bit technical 😃

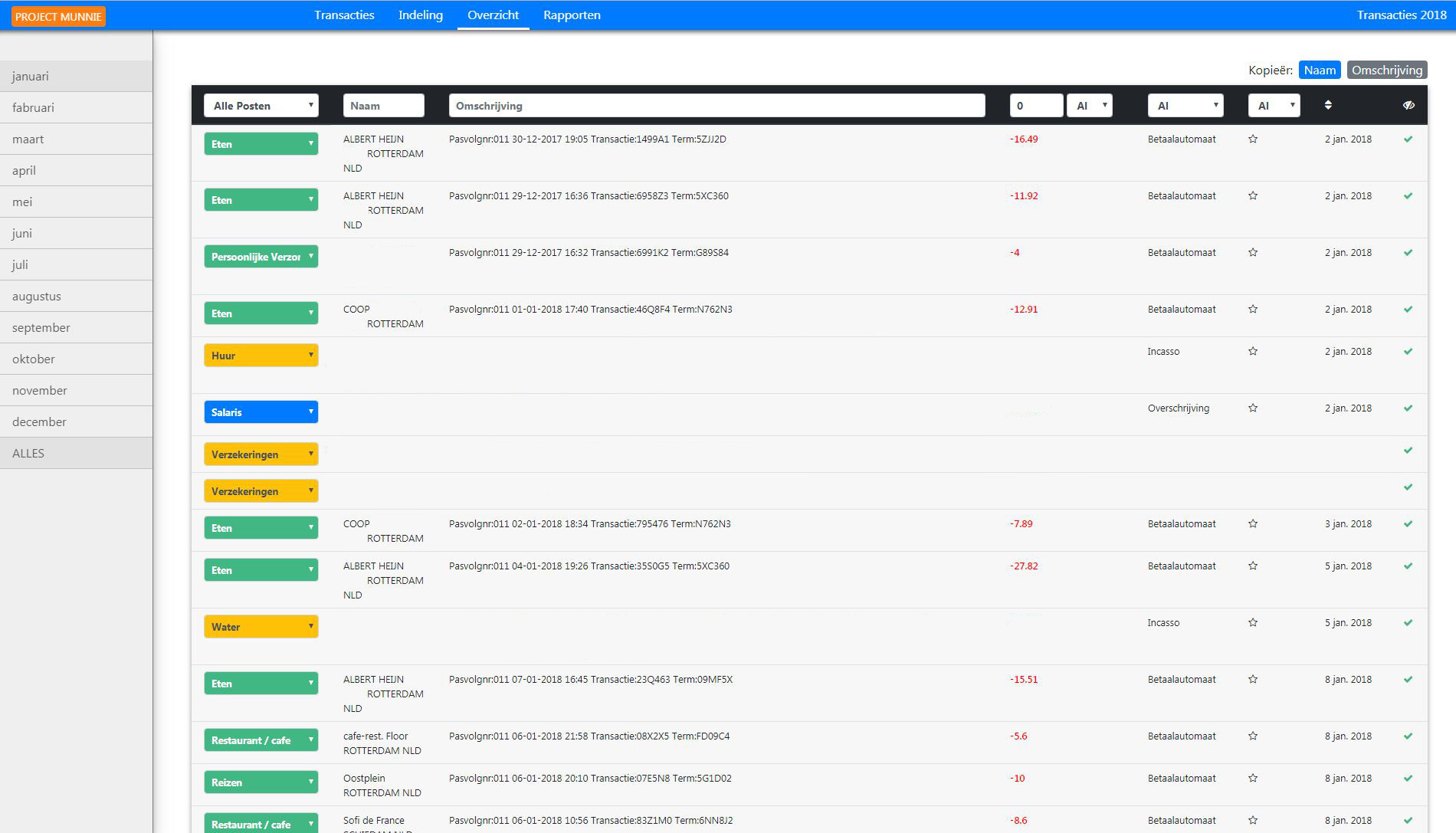

# Check if all the transactions are categorised

The 'Overzicht' page displays all the categorized transactions. Uncategorised transactions will be gray. To categorize a transaction simply click on the grayed box and change it to the desired category. Now Project Munnie will copy the name or description to that category. A little trick is to do this and then simplify the search term in the 'indeling' page so it has a wider scope. Change 'Jumbo supermarkt' to 'supermarkt' for instance so it will not only match 'Jumbo supermarket' but also 'Aldi supermarket'.

TIP

- If you want to exclude a transaction from the rapports click the most right checkmark.

- If you want to look up a transaction click on its name. It will give you automatically a Google search.

- Sometimes you rather copy the description and sometimes the name. Change this on the upper right corner.

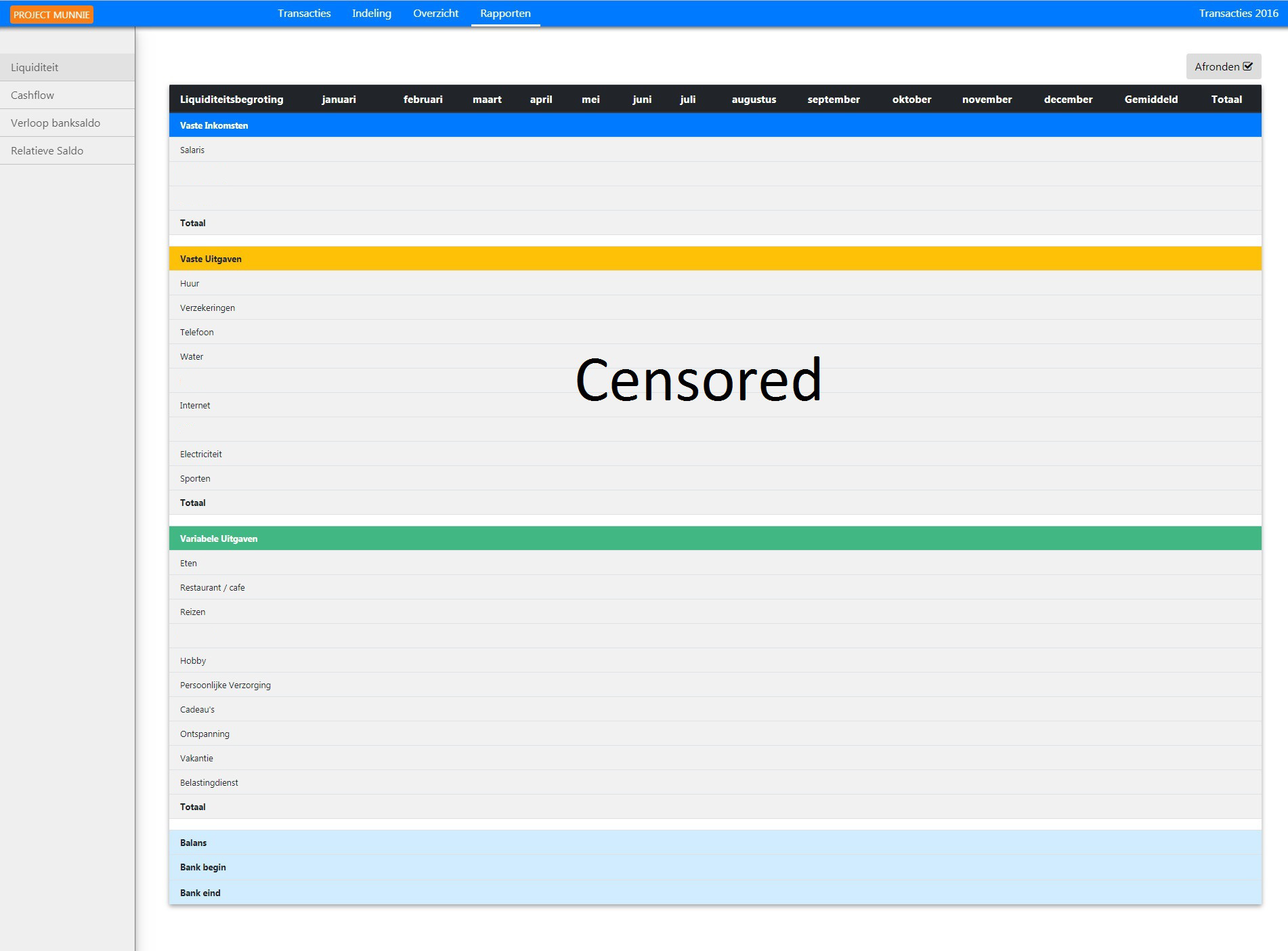

# Rapports

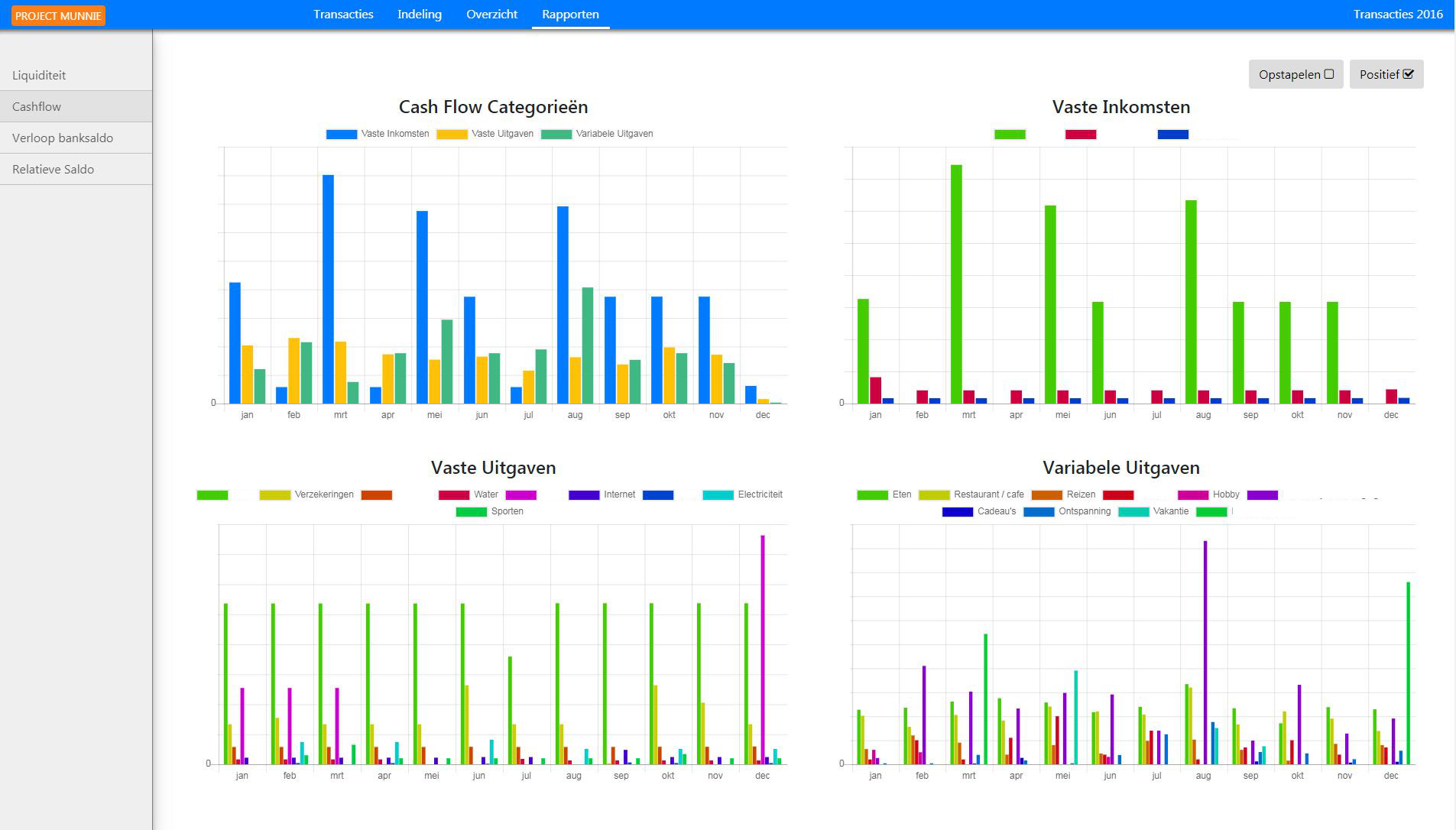

When completed Project Munnie will give you four reports !

General overview of each main category and each subcategory.

A graphical representation of your categories. Please note the two options on the upper right corner.

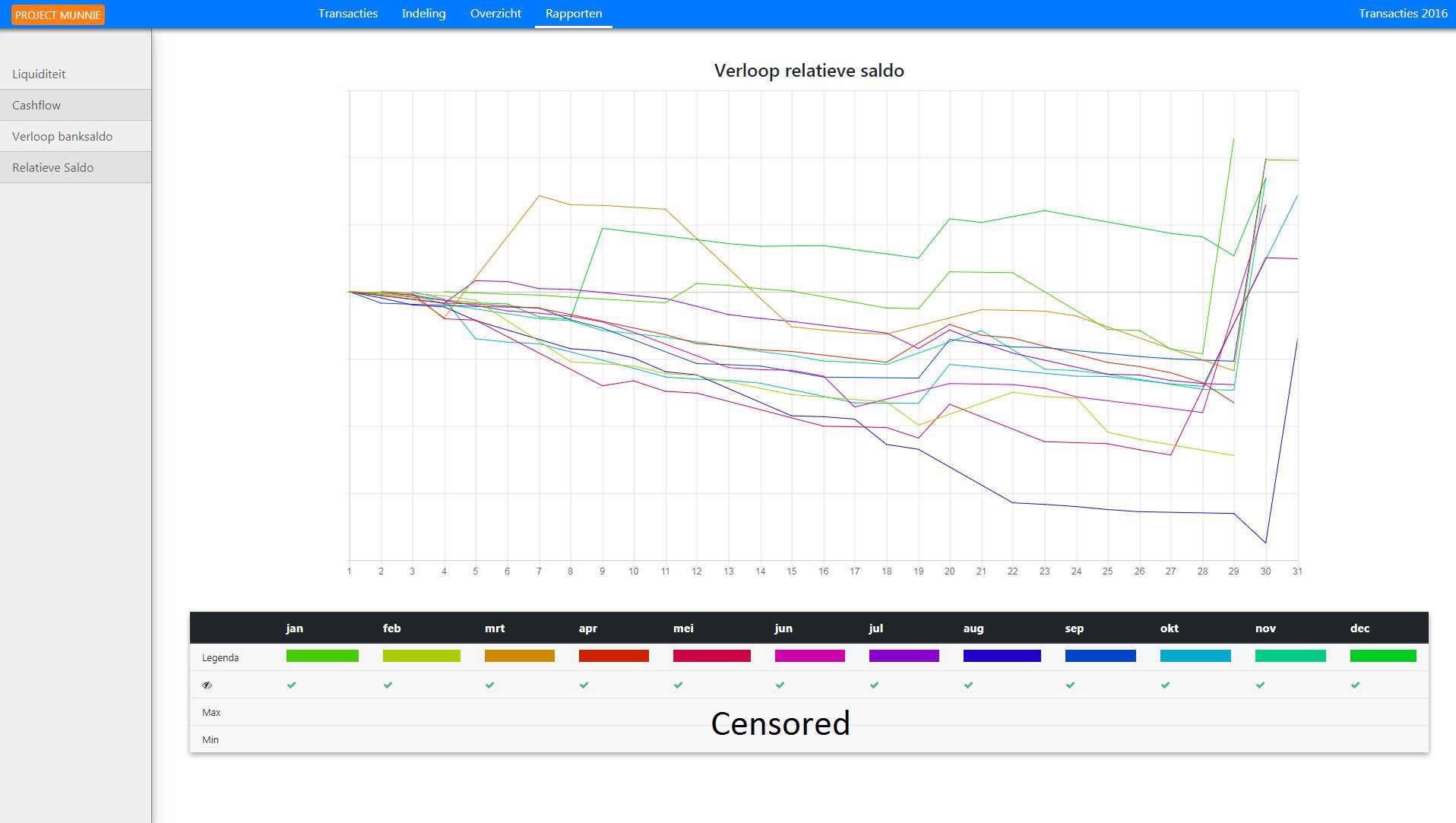

Relative balance is my custom chart, but it will give you interesting insights. You will learn:

- How is your cash generally flowing depending on the month and day of the month?

- Which months are more expensive?

- When does my boss in practice pay me? (probably highest spike uppwards)

- What is the minimum amount of money you approximately need to have on your bank account to circumvent a negative balance?

- If I check my balance today what does this number mean? Am I lower or higher than normal on that particular day of the month?

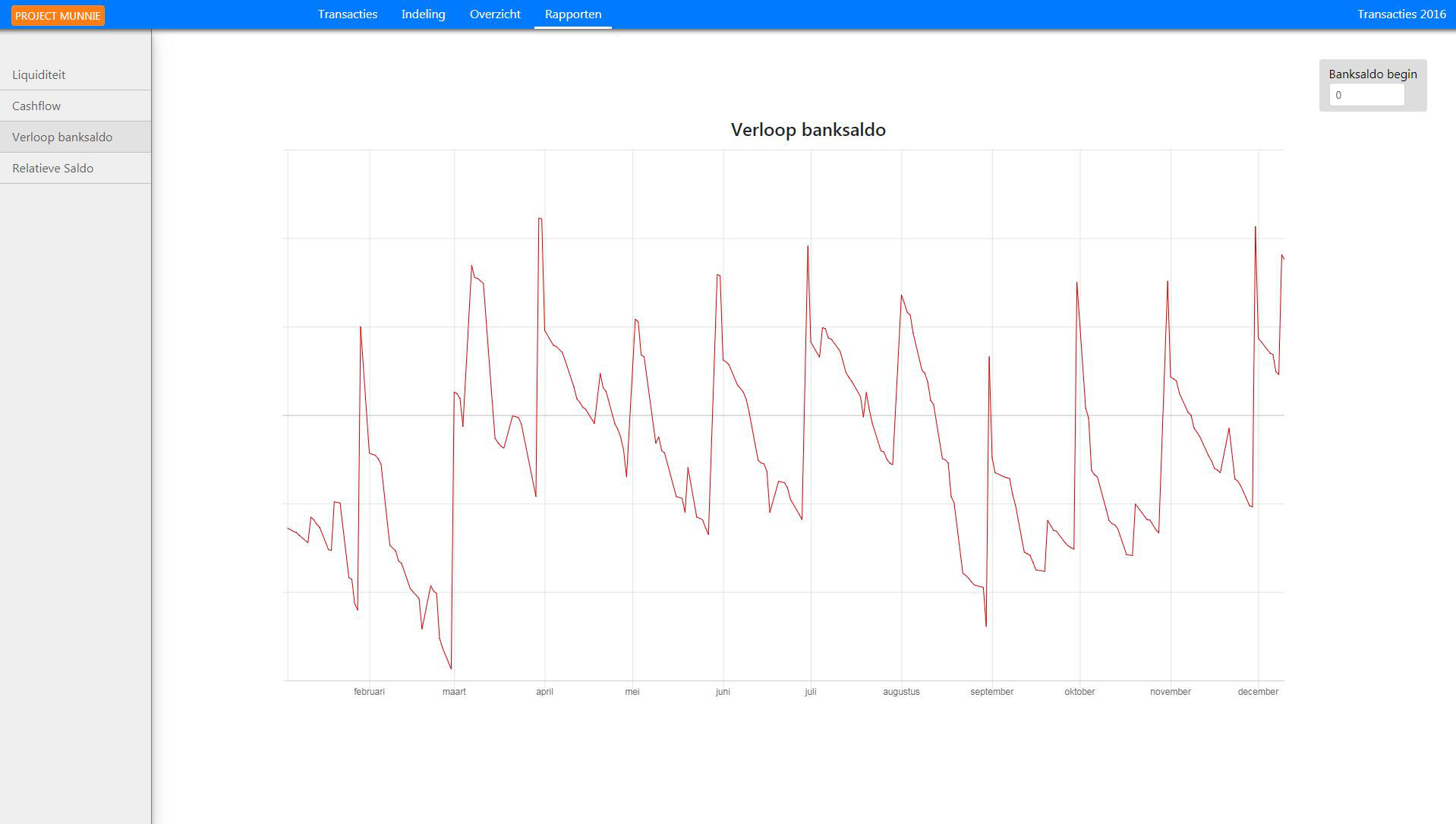

Is the general trend up or downwards? Or in other words do I make money or do I loose money? Please note that currently the graph depictures the balance of the end of the month. You can adjust your bank's starting balance in the upper right corner.

# Final thoughts

When you analyse these rapports you might get some insight in your own behaviour; in your own financial footprint so to say. Maybe you discover categories that should be minimised while others are just there and serve as your basic 'operating costs'. Or more philosophical: what would your own 'basic income' be? What things do you really need and what can you let go? How much time do you need to spend working to get your personal basic income? How much savings do I minimally need to cover the big but essential expenses (washing machine etc)? Or for freelancers how many customers do I minimally need to get independant from salary work?

I have a lot more (experimental) ideas for Project Munnie as it can become more as lifestyle tool than a bookkeeping tool. Hopefully there will more in the future.